If you own residential property, you are one of the

thousands of small business

operators who privately house over a quarter of

all Australians. If your property is commercial

then you play a vital role in support of small business,

which employs some 30% of the Australian workforce.

The Property Owners

Association of Victoria Inc., is a non profit

organization formed by property owners

who wished to assist each other obtain a fair

NET rental income from their property investments.

Whereas certain other groups of property owners, such as farmers,

have banded together most effectively in gaining almost

total relief from such imposts as council rates and land taxes;

the owners of land used for residential or commercial purposes

are now faced with a range of imposts not faced by other small business

operators and representing wealth and operating taxes.

One such impost is the increasing legalism imposed on the residential rental

operation, demanding far greater knowledge of the lessor.

Rental bonds are now held by the state

generating much interest income under the control of the government.

The interest derived from rental bonds-- clearly belonging to both lessors and lessees --

have been applied (quite properly) to fund the Tenants Union and like groups that represent in a professional manner

without charge lessees involved in tenancy disputes. Yet from

this interest not a cent has gone towards the support and training

of lessors [aka landlords]. POA-Vic does successfully assist our fellow lessors -

but lacks the resources to fund the full-fledged training sessions

required of a lessor not supported by an estate agent.

Land Tax -- an intolerable impost

Land tax is an intolerable impost on both residential and commercial property owners.

In Victoria we are faced with a Land Tax regime

not applied anywhere else in the world. And in fact, the Land Tax system is

far more oppressive in Victoria than in other states. A property owner in Victoria

who owns as an informal superannuation fund just

three houses will find that following the scheme of aggregating

values, a property tax of some 2.25% is currently applied in Victoria.

What is at once apparent is that this impost will especially interfere with the

development of private rental housing for low income families.

In NSW for comparison, aggregation is also done -- but Land Tax is capped at 1.7%

-- and in addition there are certain (in 2006 limited) exemptions where

residential housing is involved.

Already there is significant evidence of major property development

in Australia bypassing Victoria. It is notable that the Bracks government has

given some relief to the very top end of the Land Tax Table. However, the small

scale property owner has been bypassed. The POA-Vic is endeavouring to reverse

this situation -- but to be fully

effective we need more members and supporters. Our contention is that residential housing -

that is actually leased to tenants - should

be entirely free of land tax.

Protecting the Basic Human rights of Property Owners

The POA-Vic recognises that the development of the state and endeavours to protect both its natural and cultural

heritage may properly lead to limitations on the use and in some cases lead to the resumption (forced sale) of land.

In

both these

cases the POA-Vic is very concerned that the owners get proper and full compensation

for their total loss -- not just some deflated value but the true cost

- including such imposts as stamp duty for the acquisition of equivalent property

and all necessary relocation costs -

incurred. To a limited extent the Australian constitution protects

property owners by requiring compensation be paid in the

event of resumption. However the Bracks Government has proposed a

Charter for Human Right with the following

feature: The proposed Bill includes this proviso:

Clause 20 - establishes a right not to be deprived of property other than in accordance with the law.

This right does not provide a right to compensation.

The POA-vic considers the Bracks Charter for Human Rights Bill to be in fact

a Denial of Rights because of this proviso, and in various forums are expressing our opposition.

To put our position in context:

Recently there was much publicity about the routing of the Frankston Freeway extension

requiring the cutting down of a 400 year old tree. But at the same time there was no publicity

whatsoever re the situation of those property owners whose land is being resumed in part or in whole

to further these works. Individual owners may or may not have been treated unfairly,

but all know that the media will treat any moderately comfortable individual who suffers losses

in this way with little sympathy -- our society has cultivated what the Germans called

schadenfreude -- especially if the victim can be described by the pejorative term

landlord.

Help make the POAVIC strong so that we can

- Share our common experience and source experts in property management.

- Give support to individual property owners in particular cases of hardship.

- Lobby to repeal or modify relevant laws to provide better protection in the future.

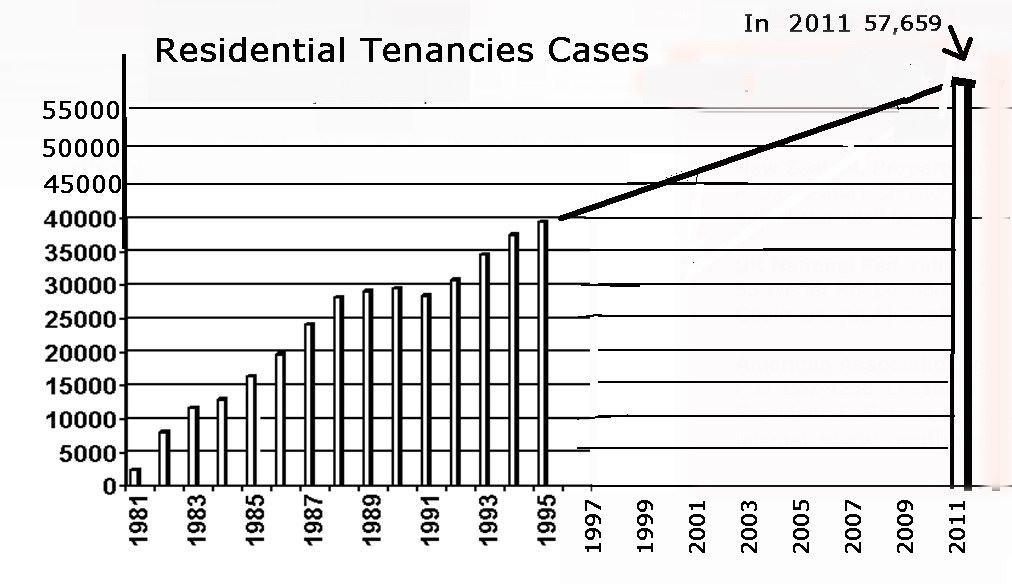

The Relentless Growth in Residential Tenancy Cases (in VCAT)